We recently wrote about AMO Residence, which was this Ang Mo Kio GLS that attracted a total of 15 bids when it was first released. In light of that, we thought it would be pretty interesting to also dig deeper into the Tanah Merah GLS site, Sceneca Residence, that too garnered 15 bids when it was released in the same year.

| Project Name | Sceneca Residence |

| Developer | MCC Land |

| District | D16 |

| Address | Tanah Merah Kechil Link |

| Land Size (sqm) | 8,880 |

| Total Units | 268 residential units |

| Tenure | 99-year leasehold |

| Nearest MRT Stations | • Tanah Merah MRT station on the East-West Line |

| Primary Schools Within 1 km (estimated) | • Bedok Green Primary School • St. Anthony’s Canossian Primary School |

| Nearby International Schools | • Middleton International School • Global Indian International School • NPS International School |

What’s around the site?

In October 2020, Chinese developer MCC Land submitted a bid of $248.99 million for this mixed-use site next to Tanah Merah MRT station, cementing its win over 14 other competitors. It was 4.6% higher than the second bid, and was the first few tenders to close since the start of the Covid pandemic. The top bid translates to a land rate of about $930 psf per plot ratio (ppr).

Clearly, the site’s main attraction is that it’s literally doorstep to an MRT station with a sheltered walkway that leads all the way to the entrance of the station. Epitome of convenience right? But if we do a deeper reading into this, it’s perhaps really because it’s located next to the Tanah Merah station.

If you look at the MRT map, Tanah Merah is just one stop away from Expo (which is next to major commercial node, Changi Business Park), two stops away from Changi Airport and four stops away from Paya Lebar.

So what we are saying is that this development’s probably going to be a decent rental investment, with a reasonably sized tenant pool that is derived mainly aviation staff and from professionals working at Changi Business Park and the commercial node encircling Paya Lebar. And with most borders opening up already, this potential has never been clearer.

Photo by shawnanggg on Unsplash

Besides proximity to MRT, Sceneca Residence also has its mixed-use status going for it. So in addition to about 265 residential units, the development will also set aside a commercial space of about 21,528 square feet.

For those who live in the vicinity, you’ll know that the area’s primarily residential with under-served retail needs, so the commercial spaces that will be introduced through this GLS site will definitely help to enliven the neighbourhood quite a bit.

Despite the lack of retail activity, it’s pretty much right at the heart of foodie haven here. Within a 10-min walking distance are two hawker centres to get your grub fix. You get The Marketplace @ 58 along Upper Changi Road as well as The Bedok Marketplace (previously known as Simpang Bedok) on the opposite direction. The latter is dubbed an “atas hawker centre” for its variety of premium stalls set within a hawker centre style setting. Adjacent to this is the East Village, a mixed-use development that houses a number of eateries.

Image credit: Little Day Out

Image: East Village

MCC Land has dealt with other mixed-use projects before—the latest being Tanjong Pagar’s One Bernam, which they are co-developing with The Place Holdings, so this isn’t exactly new territory to them.

Likewise, Sceneca Residence will also be co-developed. Back in Jan last year, MCC Land entered into a shareholders’ agreement with The Place Holdings and Ekovest Development to jointly develop the site. Having that extra boost of experience and financial assistance from the other two companies will definitely bode well for the project.

MCC Land’s no stranger to this mixed-use business though. They have another mixed-use project under their belt, Poiz Residences and Centre, completed in 2018 and located right next to Potong Pasir MRT station. There are a lot of parallels we can draw with that project, so it’s very likely we’ll see the commercial aspects of Sceneca Residence to be developer-managed as well similar to that of Poiz.

Having the developer managing the shops will be advantageous to the tenant mix. If you look at Poiz as an example, the mall, while modest, still manages to boast a healthy inventory of tenants that is not often the case with shops being sold off as individual strata titles since that usually means selling them off to the highest bidder.

A downside to living so close to an aboveground MRT though is track noise. We found that we could hear the noise from the MRT tracks quite clearly when we visited the site. It remains to be seen what the developers will do to mitigate this though. We are hoping there will be some form of noise buffer that will go some way to alleviating the noise levels, seeing as there wasn’t much done for the other condos around the area that also have units overlooking the MRT tracks.

Because of the commercial aspect to Sceneca Residence, it’s expected that the area will experience an even higher footfall than it already has, owing to being located so near the MRT. We therefore don’t expect much in the sense of exclusivity or privacy.

When is it expected to launch + A look at possible prices

We are looking at a September/October 2022 launch date for this project. According to analysts, units will likely be going for between $1,700 to $1,800 psf. There aren’t a lot any new-launch condos in the area to compare this with. The closest would probably be the 720-unit Grandeur Park Residences, which was completed back in 2020 and located on the other side of the Tanah Merah MRT. It’s currently transacting at average prices of $1,617 psf.

Indicative prices are definitely bullish, as with the trend for new-launch condos and the additional bonus of having commercial units within the site. Here’s how it compares with other neighbouring resale condos:

| TOP | Number of Units | Tenure | Average Prices (psf) | |

|---|---|---|---|---|

| Optima @ Tanah Merah | 2012 | 297 | 99-year leasehold | $1,328 |

| Urban Vista | 2016 | 582 | 99-year leasehold | $1,386 |

| East Meadows | 2002 | 482 | 99-year leasehold | $1,040 |

| Casa Merah | 2009 | 556 | 99-year leasehold | $1,208 |

| The Glades | 2016 | 726 | 99-year leasehold | $1,463 |

The condos listed above are similarly located within a short walking distance to Tanah Merah. Optima @ Tanah Merah is the closest to the MRT as it has a side gate that leads right to the station’s entrance. Prices are definitely attractive considering, but you’ll want to take note that these developments are also much older.

Looking at the plots around Tanah Merah station, there aren’t a lot of room left for development, save for a residential plot right across the road, where the station’s Exit A is. It’s currently a forested area, but it can be developed into a development with up to 12 storeys.

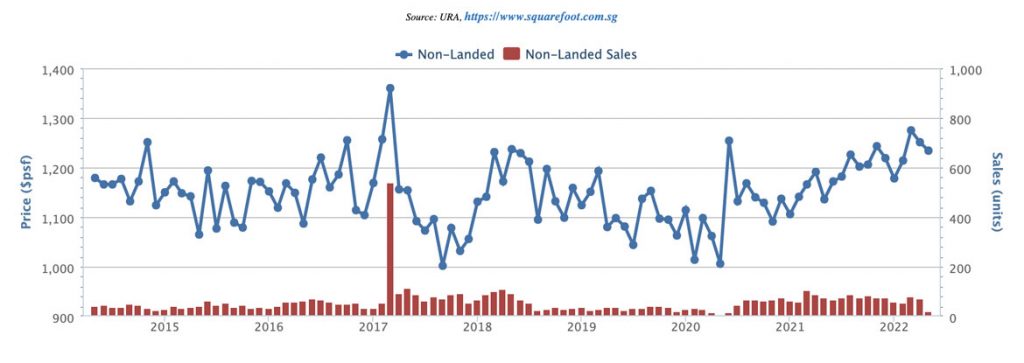

Because of this, we don’t expect prices to appreciate a whole lot in this area, although it will definitely be boosted a bit thanks to the addition of Sceneca Residence. Prices for D16 has also been relatively stable over the years, with little movement or price appreciation.

Graph credit: Squarefoot

We are definitely seeing this project more for own-stay or investment through rental. In terms of rental, rental yield for this area tends to hover between 3.1% to 3.8%, which is really quite decent.

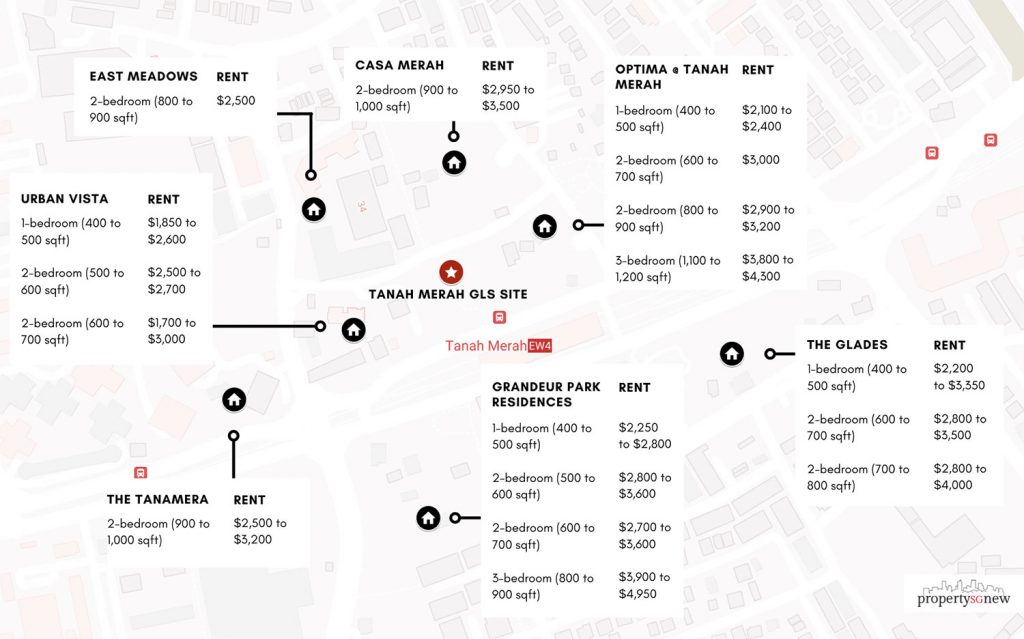

While there are a lot of condos in the area, which will make for high competition for tenants, we think there will be sufficient demand and a sizeable tenant pool, as noted in the beginning of our review, to keep rental prices high.

In terms of rental income, here’s what we are looking at if we based off on recent transacted prices:

Available Units

Click here for the latest updates on prices and units available.